What’s Been Going On With Mortgage Rates, And What Comes Next?

A look back at mortgage interest rates over 2025, with an eye toward what we can expect in 2026

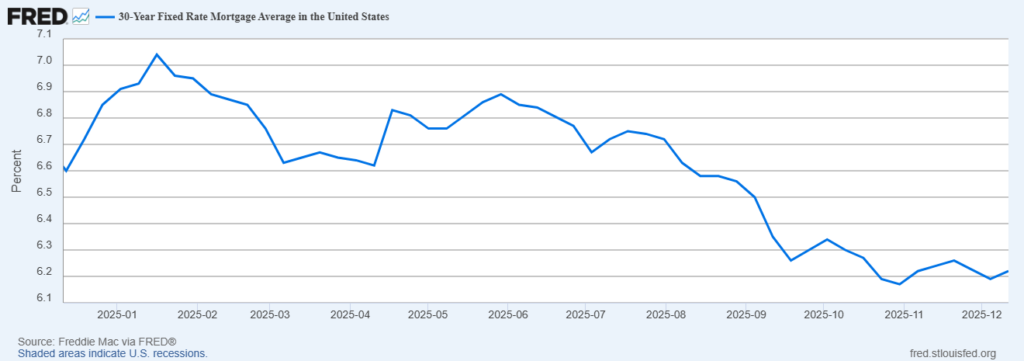

As the year winds down, I wanted to quickly revisit a frequent topic: Mortgage rates! They’ve been a bit frustrating lately. They haven’t fallen as much as many people expected, but they also haven’t shot significantly higher either. Instead, they’ve been bouncing around in a fairly tight range, mostly hovering near the low 6’s.

Just a quick reminder: These articles I share here are researched and written by me! As part of my commitment to ongoing support for my clients and partners, I write these articles to help them understand what’s really happening in the markets, beyond the headlines and soundbites.

That’s a big change from the 3% era, but it’s also meaningfully better than the 7%+ rates we saw not that long ago.

But remember: Mortgage rates are being driven more by the bond market than by the Federal Reserve Bank (Fed) itself. Even when the Fed cuts rates, mortgage rates don’t automatically drop. What matters more is the 10-year Treasury and how investors feel about the economy.

So what’s helped rates lately?

Slower economic data – especially jobs reports.

When job growth shows signs of cooling, bond yields typically fall, and mortgage rates usually follow. We’ve seen that pattern several times this year. On top of that, mortgage “spreads” – the gap between bond yields and mortgage rates – have improved from the mess they were in during 2023. That improvement alone has helped keep rates from rising further.

But here’s the reality check:

The market has already priced in most expected Fed cuts.

Unless inflation drops faster or the labor market weakens more noticeably, it’s hard to see mortgage rates falling sharply from here. Rates can drift lower, but a dramatic drop likely requires worse economic news – not better.

So what should you expect?

Most signs point to mortgage rates staying in the same general neighborhood for now, roughly around 6%, with day-to-day and week-to-week movement depending on economic data.

For buyers, that means planning around today’s rates — not waiting for yesterday’s.

For homeowners, it means being selective and realistic about refinance opportunities.

As always, strategy matters more than timing headlines.

If you find this interesting or helpful, please feel free to share it with a friend, family member, or co-worker – it’s my goal to educate and empower as many people as possible during this incredibly unique time in housing!

Here is how I can help!

- If you are looking to purchase a new home or have questions about your mortgage, the market, getting preapproved, etc., or

- If you are a Realtor Broker, or Financial Services Professional looking for a lender with great financing solutions to help educate your clients on the state of the market to help them feel good about their decisions,

Please call today – I am happy to help however I can!

I am a twenty-year veteran of the mortgage and real estate industry. My experience across nearly all aspects of real estate makes me an incredibly well-rounded problem-solver. My clients are treated to a white-glove client experience every single time. Education, information, and communication are the cornerstones of my approach.