Opportunity or Caution? The Latest Twist in Mortgage Rates After Tariff Talks

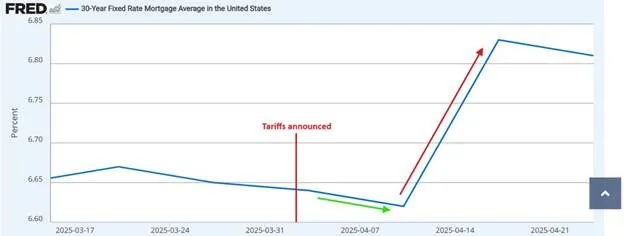

In our last newsletter, written just after the President announced massive tariffs, we discussed how the economic turmoil that resulted was actually good news for mortgage rates, pushing them down – and fast!

For a brief moment, it looked like a tremendous refinance opportunity was on the horizon for many people!

Just a quick reminder: These articles I share here are researched and written by me! As part of my commitment to ongoing support for my clients and partners, I write these articles to help them understand what’s really happening in the markets, beyond the headlines and soundbites.

Well, that turned out to be a very short-lived opportunity. Within a few days of the announcement, the financial markets became a untethered and as a result, mortgage rates shot back up. (When I say the markets “became untethered,” what I mean is that mortgage rates shot up when by all other logic & history, they should have continued falling.) In fact, rates climbed back to higher than what they were before the tariff announcement!

Since then, there have been announcements that have calmed the markets: A 90-day pause on tariff implementation as well as an exemption on certain goods from China.

Those announcements have brought some normalcy back to the markets, which is a good thing: When markets behave like they typically do, the direction (and velocity) of mortgage rates can be fairly predictable. But when markets become unglued like they recently did – usually as the result of dramatic and/or unexpected world news – rate can fluctuate quickly and severely.

Mortgage rates today, April 30 2025, remain slightly higher than they were prior to the initial tariff announcement.

The outlook: Cautiously optimistic, but guarded

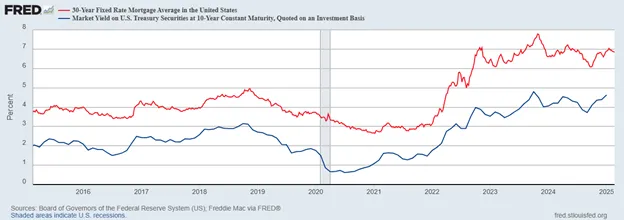

In this newsletter, we’ve discussed the importance of the 10-year US Treasury Bond (UST10) relative to mortgage rates – that since the 1970s, mortgage rates have moved in tandem the yield on the UST10.

We have also discussed that this White House Administration has publicly stated a goal of lowering the yield of the UST10, which has the effect of lowering mortgage rates as well. For homeowners and prospective homebuyers, lower rates is great news.

Our outlook remains guarded, however, as we have recently seen how quickly and sharply the market can react when anxiety and uncertainty about economic conditions arise. As trade talks continue, the market remains prone to volatility. Until we are in calmer economic waters, I would advise any client to lock their interest rate sooner than later.

There is some potentially good news on the horizon as well. As the labor market continues to soften, the Federal Reserve (FED) is more likely to consider cutting rates. While FED rate cuts (or increases) don’t always directly affect mortgage rates, it’s expected that a FED cut – or even optimism for one – could drive rates lower in this environment. Additionally, if GDP continues to weaken, the FED may also be more inclined to consider cuts.

So now what?

The last 30 days for mortgage rates has been a good reminder of how quickly things can turn – for better and worse. For anyone considering buying a home, the most important thing is the timing of the purchase (relative to Life Events) and the price for the home. While rate will affect monthly payment to some degree, it’s important to not fixate on rate and try to “time” the market if you need to buy a home.

For homeowners who bought in the last 3 years, it’s important to stay alert for potential refinance opportunities. As we saw with this recent tariff announcement, the opportunity for a refinance can be very short, so it’s important to be ready to seize it when it arrives.

If you find this interesting or helpful, please feel free to share it with a friend, family member, or co-worker – it’s my goal to educate and empower as many people as possible during this incredibly unique time in housing!

– If you are looking to purchase a new home or have questions about your mortgage, the market, getting preapproved, etc., or

– If you are a Realtor, Broker, or Financial Services Professional looking for a lender with great financing solutions to help educate your clients on the state of the market to help them feel good about their decisions,

Please call today – I am happy to help however I can!

I am a twenty-year veteran of the mortgage and real estate industry. My experience across nearly all aspects of real estate makes me an incredibly well-rounded problem-solver. My clients are treated to a white-glove client experience every single time. Education, information, and communication are the cornerstones of my approach.