Profile

As an experienced Mortgage Loan Officer, Lynn understands that the process of securing a mortgage can be intimidating. That's why she takes the extra time to discuss any financial or budgetary concerns and guides her clients through the mortgage process every step of the way.

Recognizing that buying a home is likely the biggest financial investment you will make, Lynn’s primary objective is to minimize the stress associated with the home buying process. Her commitment is to ensure that her clients are in the best position to have your strongest offer accepted on the home of their dreams.

With her personalized approach, Lynn will take you through each step of the home buying process, providing comprehensive support along the way. She goes the extra mile to ensure that her clients are financially and emotionally prepared for homeownership before submitting an offer on a new home. Additionally, Lynn will keep you updated throughout the process and will always be available to address any questions or concerns you may have.

Lynn loves helping home owners with their financing!

See her amazing testimonials here on Google Reviews!

Lynn’s Blog

Mortgage Terms Made Simple: A Friendly Guide for Anyone Feeling a Little Lost

If you’ve ever dipped a toe into the world of home loans and felt like you were suddenly swimming in…

What Today’s Debt Trends Tell Us About Tomorrow’s Opportunities

This month, I want to talk about something that might sound a little dry at first—but is actually very relevant right now:…

How Gifted Money Can Help With Your Mortgage

In the world of mortgages, “gift funds” can be a powerful tool to help make homeownership more accessible, especially for…

The 50-Year Mortgage: Is It Helpful or Hype

If you’ve been watching housing headlines, you’ve probably noticed all the talk about affordability. With fast-rising prices, low inventory, and…

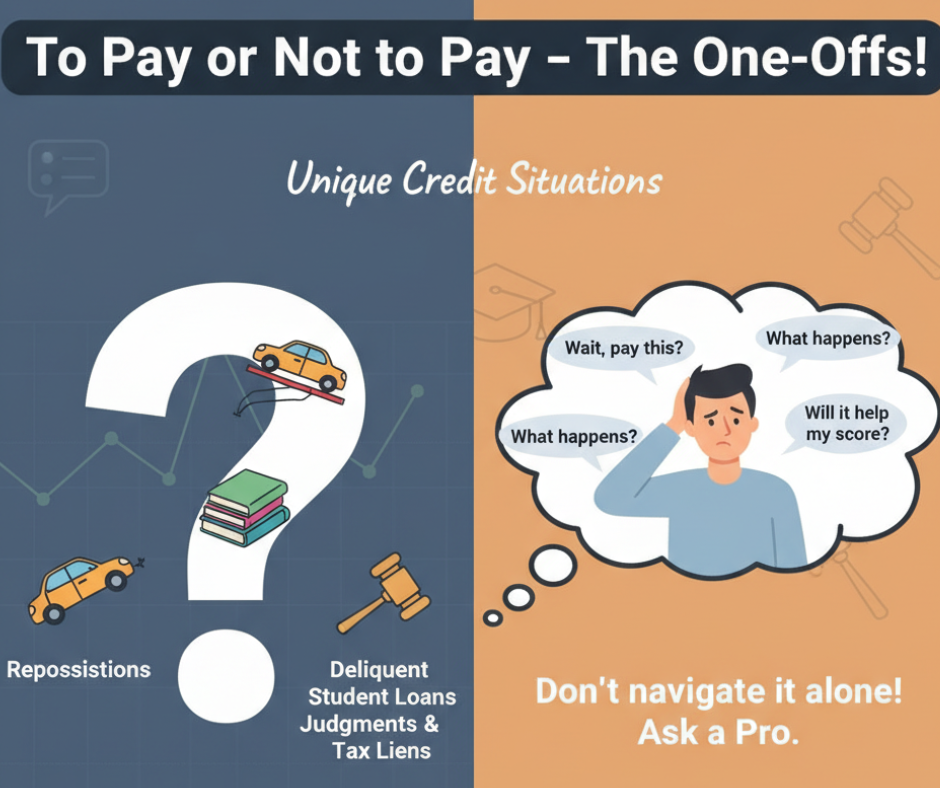

To Pay or Not to Pay – Let’s Talk Charge Offs!

Let’s dig into charge offs—those confusing little credit gremlins that often get lumped together with collections. While they might seem…

What You Should Know About Buy Now Pay Later

Lately, I’ve been getting a lot of questions about Buy Now Pay Later (BNPL) accounts—not just from industry professionals, but…