Housing is still tight. Rates remain stubborn. Why, and what’s next?

Can you believe we’re almost halfway through 2025 already?

The first half of this year has been an interesting one for housing, as financial markets try to adapt to a new administration in the White House. Let’s look at the bigger picture to see what may be in store for the rest of 2025 when it comes to housing and mortgages!

Just a quick reminder: These articles I share here are researched and written by me! As part of my commitment to ongoing support for my clients and partners, I write these articles to help them understand what’s really happening in the markets, beyond the headlines and soundbites.

DC Drama

As Congress wrestles with the details of the Big Beautiful Bill (BBB), it’s important to understand what its passage may mean for financial markets.

The BBB is expected to add between $3.8 trillion & $5.7 trillion to the national debt over the next ten years. Such an increase in debt would likely lead investors to demand higher yields on US Treasury bonds. An increased yield on the 10-year US Treasury bond would push mortgage rates higher, which would likely slow down real estate sales activity.

In addition to the passage of the BBB, the financial markets are also very sensitive to changes in US fiscal policy in general. This has resulted in volatility for mortgage rates.

Inventory

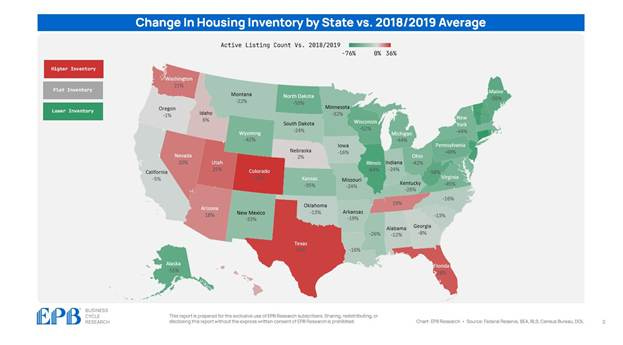

While housing inventory remains a challenge for us here in our local markets, there are some parts of the country where inventory is now higher than it was pre-pandemic. These tend to be markets that saw the hottest price growth over the past few years, such as Texas and Florida. As inventory increases, it’s expected that price growth will cool and could possibly turn negative.

However, Michigan’s housing inventory levels remain significantly below the 2018/2019 average by a measure of 44%.

Labor > Inflation

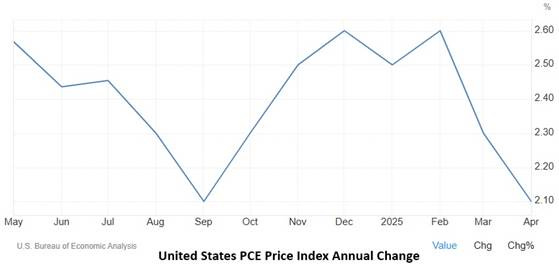

As The Federal Reserve (FED) began hiking rates in 2022, its stated target for inflation was 2%. Except for a small spike, the FEDs favorite measure of inflation, PCE, has been trending towards 2%.

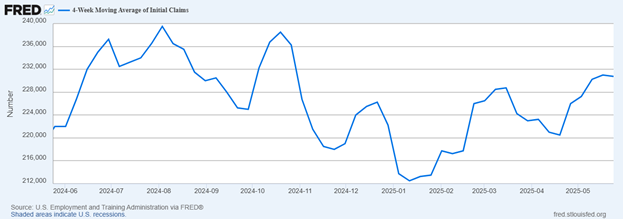

The fact that the FED has been zeroing in on its PCE goal but has not yet cut rates – or signaled that cuts will come soon – tells us that it values labor over inflation. Some prominent analysts believe that the FED will begin cutting rates once the 4-week moving average of Initial Jobless Claims reaches 323,000. As you can see, we’re not quite there yet:

Rate outlook

For the foreseeable future, our outlook for lower mortgage rates remains guarded. Absent any economic scare or significant softening of labor market, it’s hard to see a path for mortgage rates to fall to the low 6’s.

However, as the financial markets seem to hinge on every action – or proposal – out of Washington DC, this outlook could change. There was some positive movement earlier in the year for mortgage interest rates, but ongoing uncertainty in Washington DC makes it challenging to forecast just when we can expect to see significantly lower rates.

If you found this interesting or helpful, please share it with a friend, family member, or co-worker – it’s my goal to educate and empower as many people as possible during this incredibly unique time in housing!

Here is how I can help:

– If you are looking to purchase a new home, have questions about your existing mortgage, getting preapproved, or refinancing, etc., or

– If you are a Realtor, Broker, or Financial Services Professional looking for a lender with great financing solutions to help educate your clients on the state of the market to help them feel good about their decisions,

Then please call today – I would love the opportunity to serve however I can!

I am a twenty-year veteran of the mortgage and real estate industry. My experience across nearly all aspects of real estate makes me an incredibly well-rounded problem-solver. My clients are treated to a white-glove client experience every single time. Education, information, and communication are the cornerstones of my approach.

NMLS1109257