Housing 2024: Competition continues to increase, but it’s not just among buyers

The real estate industry is undergoing significant consolidation as transaction volumes slide.

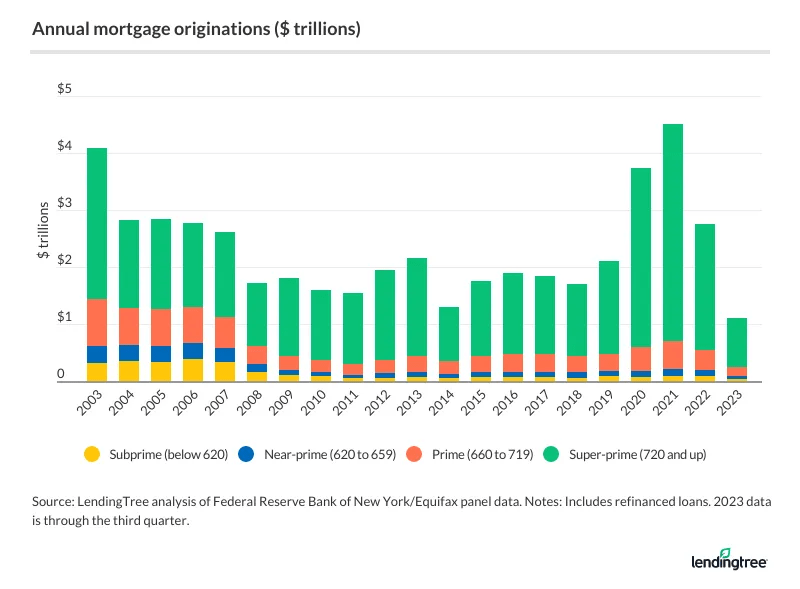

The past few years have been a roller coaster for mortgage professionals. Since the record-breaking year of 2021, mortgage origination volume has shrunk by almost 75%. This is largely due to the unusual combination of extremely low housing inventory and mortgage interest rates that have more than doubled in 18 months. Across the board, real estate transactions have decreased significantly in recent years.

The result is an increase in competition among real estate and mortgage professionals. With fewer transactions in the marketplace, professionals are fighting tooth-and-nail for every transaction.

Just a quick reminder: These articles I share here are researched and written by me! As part of my commitment to ongoing support for my clients and partners, I write these articles to help them understand what’s really happening in the markets, beyond the headlines and soundbites.

Ultimately, this competition among professionals will be good for the consumer. As I’ve written before, the barrier to entry to the real estate industry is so low you could trip over it. That has resulted in thousands of “part-timers” entering the industry, looking to make “easy money” “on the side.” But as the industry contracts and transactions dwindle, the marketplace will naturally weed out the poor performers.

We’re already seeing significant consolidation in the mortgage industry. According to Ingenius, tens of thousands of licensed Loan Originators left the industry in 2023. In October of 2023, a whopping 67% of current Loan Originators did not close a single transaction. In fact, only 12% of Loan Officers closed more than 2.5 transactions per month as of October 2023.

The consolidation continues at the highest levels with the biggest industry players. Rocket Mortgage just announced the termination of its Third Party Origination partnership with non-mortgage professionals. For years, Rocket Mortgage allowed other professionals like real estate agents, insurance providers, tax preparers, financial planners, and more to originate mortgages. Rocket’s decision to terminate this program underscores the fact that mortgage loan origination requires intense training, experience, and focus: One cannot simply “jump in” to being a mortgage professional.

The housing industry is undergoing some serious changes. While it’s painful for the professionals who have dedicated their lives to serving clients in this industry, these changes will benefit the industry as a whole. As less-qualified players are forced out of the market, the result will be a marketplace populated by true professionals who are passionate about – and capable of – serving their clients at the highest level.

If you find this interesting or helpful, please feel free to share it with a friend, family member, or co-worker – it’s my goal to educate and empower as many people as possible during this incredibly unique time in housing!

Here is how I can help!

- If you are looking to purchase a new home or have questions about your mortgage, the market, getting preapproved, etc., or

- If you are a Realtor or a Broker looking for a lender with great financing solutions to help educate your clients on the state of the market to help them feel good about their decisions,

Please call today – I am happy to help however I can!

☎ 248.956.0445 📧 brian@goforwardmortgage.com

Brian Mutter is a twenty-year veteran of the mortgage and real estate industry. His vast experience across nearly all aspects of real estate makes him an incredibly well-rounded problem-solver. Brian’s clients are treated to a white-glove client experience every single time. Education, information, and communication are the cornerstones to his approach.