Home Prices, Inventory, and Interest Rates – A Delicate Balance

In our last newsletter, we discussed the possibility that mortgage rates would remain higher for longer than many anticipated. Here, we’ll discuss the housing side of the market, which really comes down to inventory and home prices.

Just a quick reminder: These articles I share here are researched and written by me! As part of my commitment to ongoing support for my clients and partners, I write these articles to help them understand what’s really happening in the markets, beyond the headlines and soundbites.

Supply and prices

Limited supply still continues to boost home prices, though we have seen that higher interest rates do have a cooling effect on home prices. There is an important dynamic between home prices and interest rates that we’ll discuss in a bit. But despite higher rates thinning the pool of buyers, sellers are still outnumbered – heavily – by buyers.

Inventory, and a brief history

We are approaching the inventory peak for 2023, when there were 569,898 homes for sale. That was in November, as rates climbed. We saw then what we are seeing now: Higher interest rates (for a longer period of time) allow for housing inventory to grow.

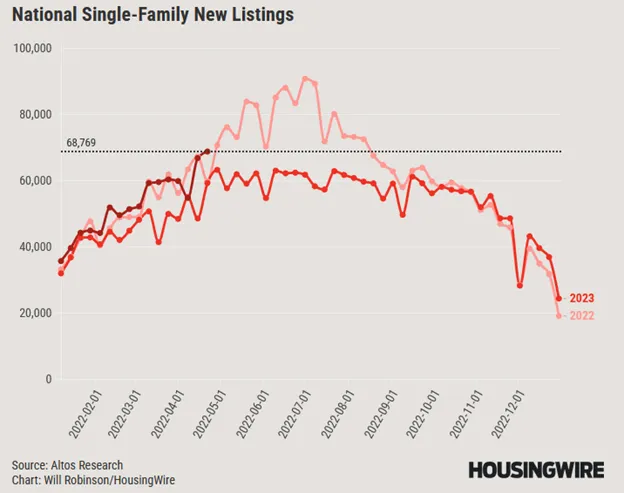

In a healthy sign for housing, new listings are up about 15% from this time last year.

Some context: This week in 2015, there were 1,060,669 total active listings.

This week, in 2024, there are 543,044 active listings.

While we’re at half the volume of listings of 2015, we have more active inventory now than we did this time in 2023, which is a positive sign.

Interest rate effect

As we’ve pointed out, higher rates have allowed inventory to grow, as the number of buyers shrinks as rates climb.

However, it should be expected that lower rates will bring more buyers to the market and ultimately reduce overall listings. In turn, the combination of more buyers and the resulting decrease in available homes for sale will drive prices up.

So what’s up with rates?

The last two weeks were not great for mortgage interest rates, as the market digested hotter-than-expected inflation reports, a resilient labor market, and uncertainty in the Middle East. In many loan scenarios, interest rates increased by as much as .5%, which can be a difference of $100 per month on a $300,000 mortgage. And as we look to the rest of this year, the uncertainty remains, with the main culprits being inflation, the labor market, and global conflict.

Below is a chart that tracks the value of Mortgage Backed Securities (MBS), on which mortgage interest rates are based, for the last 90 days. Their relationship is inverse – as MBS increase in value, mortgage interest rates decrease. When MBS decrease in value, interest rates rise.

Aside from the overall volatility, you’ll see that we have had some incredibly challenging days:

So is now a good time to buy or what?

For most, buying a home is not some elective choice made on a whim. Instead, most people buy because certain Life Events make buying a home – permanently owning your shelter – a natural, logical, practical decision. People fall in love, get married, form families, kids grow and move out, people get jobs in new towns, people upsize, people downsize, etc.

And in each of those cases, the best thing to be is prepared – both with knowledge of the market, and with a strong team of professionals to represent you. None of us have any control over the market. But by having a firm understanding of the dynamics, trends, and opportunities that exist in the market, you’re able to make good, sound, informed decisions about buying a home.

If you find this interesting or helpful, please feel free to share it with a friend, family member, or co-worker – it’s my goal to educate and empower as many people as possible during this incredibly unique time in housing!

Here is how I can help!

- If you are looking to purchase a new home or have questions about your mortgage, the market, getting preapproved, etc., or

- If you are a Realtor or a Broker looking for a lender with great financing solutions to help educate your clients on the state of the market to help them feel good about their decisions,

Please call today – I am happy to help however I can!

☎ 248.956.0445 📧 brian@goforwardmortgage.com

Brian Mutter is a twenty-year veteran of the mortgage and real estate industry. His vast experience across nearly all aspects of real estate makes him an incredibly well-rounded problem-solver. Brian’s clients are treated to a white-glove client experience every single time. Education, information, and communication are the cornerstones to his approach.