Lynns Blogs

Mortgage Terms Made Simple: A Friendly Guide for Anyone Feeling a Little Lost

If you’ve ever dipped a toe into the world of home loans and felt like you were suddenly swimming in alphabet soup—LTV, DTI, PMI—you’re not alone. Even seasoned pros stop and blink at these acronyms sometimes. The good news? These terms don’t have to be intimidating. Once you understand the basics, the whole mortgage process…

Read MoreWhat Today’s Debt Trends Tell Us About Tomorrow’s Opportunities

This month, I want to talk about something that might sound a little dry at first—but is actually very relevant right now: the Federal Reserve’s Q3 2025 Household Debt and Credit Report. You might be wondering, “Why Q3? What about Q4?”Those numbers are coming, but these reports take time to compile. The good news is that Q3 still gives…

Read MoreYour Go-To Guide on Buying a Home After a Credit Setback

Life has a way of throwing curveballs, and sometimes those curveballs hit our finances hard. Bankruptcy, foreclosure, a short sale—these moments can feel like the end of the road for homeownership. But here’s the part most people don’t realize: these setbacks don’t have to define your future. With the right plan and a bit of…

Read MoreHow Gifted Money Can Help With Your Mortgage

In the world of mortgages, “gift funds” can be a powerful tool to help make homeownership more accessible, especially for first-time buyers. What Are Gift Funds? Gift funds are sums of money given by one person to another without the expectation of repayment. These funds can be applied toward a homebuyer’s down payment, closing costs,…

Read MoreThe 50-Year Mortgage: Is It Helpful or Hype

If you’ve been watching housing headlines, you’ve probably noticed all the talk about affordability. With fast-rising prices, low inventory, and mortgage rates that haven’t exactly been kind, it’s no surprise buyers are feeling squeezed. One of the newest “big ideas” being floated is the 50-year mortgage. On the surface, it sounds simple; stretch the loan term,…

Read MoreThe Hidden Power of Homeownership: Why It’s the Cornerstone of Wealth

There’s a reason homeownership is called the American Dream – and the numbers back it up. According to Barry Habib from MBS Highway and data from the National Association of Realtors (NAR): Two-thirds of an individual’s net worth comes from home equity A homeowner’s net worth is 43 times greater than that of a renter As of mid-2025, Realtor.com and NAR reported that: The median homeowner’s net…

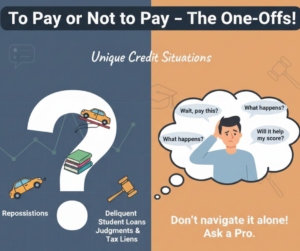

Read MoreTo Pay or Not to Pay – The One-Offs!

These are the unique credit situations that don’t fit neatly into the usual categories. They’re the ones that make people stop and ask, “Wait, should I actually pay this?” or “What happens if I do?” Now normally I’d start off with a nice little definition, but let’s be honest — this group is kind of…

Read MoreThink Paying That Old Debt Will Help Your Score? Maybe Not…

“Should I pay off this collection from 2020?” Whew—if I had a dollar for every time someone asked me that! It’s one of the most common credit questions I get, and for good reason—it’s confusing!. So let’s break it down. When does paying off a collection help your score, and when could it actually hurt? First things first—what is a…

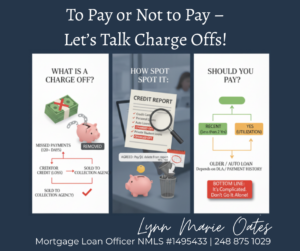

Read MoreTo Pay or Not to Pay – Let’s Talk Charge Offs!

Let’s dig into charge offs—those confusing little credit gremlins that often get lumped together with collections. While they might seem similar, they’re definitely not the same thing. Let’s break it down in plain English. What Is a Charge Off? Think of a charge off as a debt that a creditor has basically given up on collecting. After…

Read MoreWhat You Should Know About Buy Now Pay Later

Lately, I’ve been getting a lot of questions about Buy Now Pay Later (BNPL) accounts—not just from industry professionals, but from friends and clients too. So, I put together this quick guide to help break it all down in plain, simple terms. Here’s what you should know. What is Buy Now, Pay Later? Buy Now…

Read More