Mortgage rates: Still held up by the labor market

It’s been an interesting Summer this year when it comes to housing and financial markets! In many ways, it feels like the markets have been holding their breath. But why?

What’s the FED waiting for?

All eyes have been on the Federal Reserve (FED), with the hope that they’ll cut interest rates. After all, the FEDs preferred measure of inflation has hovered just over its target of 2% for months.

Just a quick reminder: These articles I share here are researched and written by me! As part of my commitment to ongoing support for my clients and partners, I write these articles to help them understand what’s really happening in the markets, beyond the headlines and soundbites.

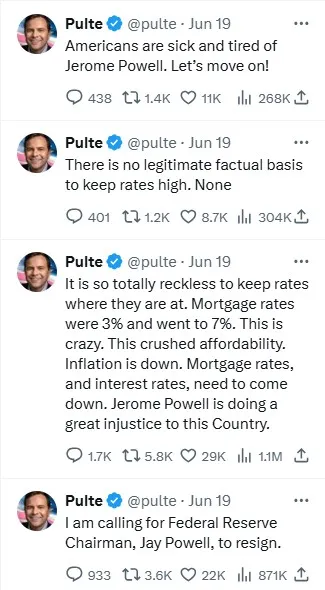

And in Washington, pressure has been heating up from both the President and Bill Pulte, the director of the Federal Housing Finance Administration (FHFA). Pulte has launched a public pressure campaign aimed at getting Federal Reserve Chairman Jerome Powell to resign. What Pulte really wants is for Powell to cut rates, which he says are hampering the already-sputtering housing market.

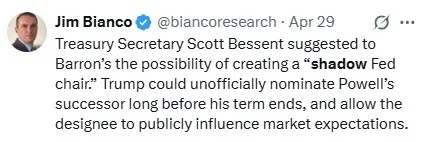

In the meantime, the idea has been floated of President Trump appointing a “Shadow” FED President, as a way to influence financial markets and push down mortgage rates (without having the authority to cut the actual FED rate) while Powell completes the rest of his term, which is set to expire on May 15, 2026.

Yet despite all this pressure, Powell still hasn’t cut rates. What gives?

The FED has tamed inflation to near its target, and now its Chairman is getting browbeaten in public, and it’s still not cut rates. This illustrates what we’ve written here for months: The FED is prioritizing labor data over inflation data (and pressure, apparently) when it comes to cutting rates.

Look no further than the July Jobs Report from the Bureau of Labor Statistics. That report showed that the US economy added 147,000 jobs in June, and unemployment fell to 4.1%. The financial markets understand that the FED will not cut rates while the labor market is this strong, and bond yields – and mortgage rates – increased on the news.

What does this mean for me?

If the labor market remains this robust, we don’t anticipate significant changes to mortgage rates. Don’t wait for lower rates to buy a home, as no significant rate reduction is on the horizon. But, if you bought a home in the last four years, be prepared to consider refinancing once the labor market begins to break.

In Michigan, our housing inventory levels remain significantly below their 2018/2019 levels. Against this backdrop, the possibility of falling mortgage rates could be a double-edged sword: For those considering buying a home, while lower rates mean lower monthly payments, falling rates will also likely bring more buyers to the market, increasing competition. As we’ve seen over the past several years, increased competition among buyers can lead to higher home prices.

For prospective buyers, the game plan should remain the same: Stay ready (preapproved) so that when you find your Dream Home, you can make an offer immediately. Buyers who remain on the sidelines waiting for rates to fall may find themselves disappointed if rates do not fall – or, if they do fall, they may find themselves in an even more competitive market.

If you find this interesting or helpful, please feel free to share it with a friend, family member, or co-worker – it’s my goal to educate and empower as many people as possible during this incredibly unique time in housing!

Here is how I can help!

– If you are looking to purchase a new home or have questions about your mortgage, the market, getting preapproved, etc., or

– If you are a Realtor, Broker, or Financial Services Professional looking for a lender with great financing solutions to help educate your clients on the state of the market to help them feel good about their decisions,

Please call today – I am happy to help however I can!

I am a twenty-year veteran of the mortgage and real estate industry. My experience across nearly all aspects of real estate makes me an incredibly well-rounded problem-solver. My clients are treated to a white-glove client experience every single time. Education, information, and communication are the cornerstones of my approach.

☎ 248.956.0445 📧 brian@goforwardmortgage.com